Comprehensive Review dedicated to traders from Nigeria

IQ Option Review Nigeria

Accepts Nigerian Clients

Who is IQ Option?

IQ Option is an international broker that launched its services in 2013. Since then, the number of registered users on the platform has multiplied, making it one of the top brokers for Forex, CFDs and Binary Options. Clients can access over 31 different forex pairs and various other trading instruments like stocks, ETFs, crypto, indices, and commodities. Additionally, Nigerian traders can trade here also binary and digital options. What's more, the broker offers a sophisticated trading platform and various tools to help traders achieve their goals.

The broker is available to Nigerian traders and offers a fairly high leverage of up to 1:500. IQ Option has a minimum deposit of $10, which is among the lowest in the market. This is approximately equal to 7,705 in Naira.

Risk warning: Remember that forex and CFDs available at IQ Option are leveraged products and can result in the loss of your entire capital.

Trading Options is also very risky. Please ensure you fully understand the risks involved.

Pros

Cons

Trading Forex and CFDs entail risk.

Trading Options is also risky.

Your capital is at risk.

01

Trading assets on IQ Option

IQ Option offers various trading instruments to give traders diversity in their investments. The broker offers its clients access to more than 250 different trading instruments. Nigerian traders can trade CFDs on:

- Forex – IQ Option offers 31 different forex pairs that include EURUSD, USDJPY, AUDUSD, and many more. The collection of currency pairs on this broker site includes majors, minors, and exotics.

- Cryptocurrencies – IQ Option also offers a variety of popular cryptocurrencies for Nigerian traders to invest in. These include Bitcoin, Ethereum, Ripple, and many more.

- Commodities – Further, traders can speculate CFDs on hard or soft commodities such as gold, silver, oil, and many more.

- Indices – Indices are also available for Nigerian investors to trade. They can select over 12 different indices CFDs. The indices offered are widely traded indices representing a particular market sector or national economy.

- Stocks – Traders can trade over 183 different stocks or make long-term investments on the same platform. The company offers stock from countries like the UK, the US, and many more.

- ETFs - Nigerian traders can diversify their trading with over 22 ETFs including Gold Miners ETFs, Technology SPDR, and many more.

Available Deposit & Withdrawal Methods

IQ Option supports the following deposits and withdrawal methods

Supported Platforms by IQ Option

IQ Option supports the following trading platforms

02

Trading platforms of the broker

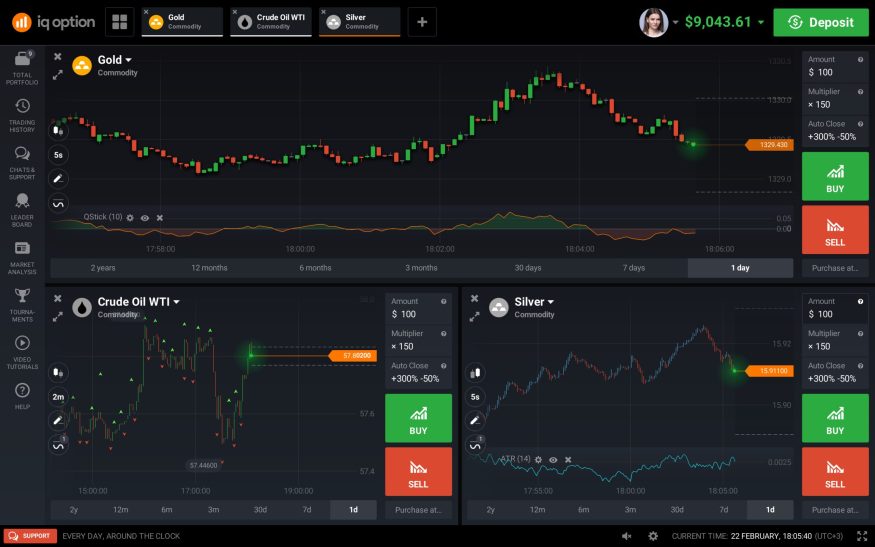

IQ Option offers an in-house-built trading platform compatible with desktop Windows, MacOS, Web, and Mobile. The platform is market-standard and it has everything a trader is looking for. It comes with a plethora of technical analysis tools to help traders on their journey.

This is because the tools allow traders to make fast decisions at any given time and stay up to date with market-related news. What's more, traders can be guaranteed a seamless trading experience with fast execution execution.

Most orders are executed at an average rate of 0.6 seconds. Further, the platform is equipped with tools to help a trader in the decision-making process which include a multi-chart layout.

The platform is suitable for both advanced and new traders as it is both intuitive and powerful. Also when using the app, there are features such as stop loss/Take profit, and Trailing stop that help manage losses and maximize profits.

Trading Forex and CFDs entail risk.

Trading Options is also risky.

Your capital is at risk.

03

A Review of IQ Option Trading Fees

There are three main fees that IQ Option charges to its clients. These include spreads, overnight fees, and inactivity fees. Let’s briefly look at these three fees.

Spreads

This is the main charge traders have to pay when trading with IQ Option. This is the difference between the bidding price and the asking price. The broker pockets the small difference as profit. Normally, the most traded assets on a broker site have the lowest spreads. For major currency pairs, the spreads on IQ Option are fairly and industry standard. They start from as low as 1.0 pips with no commissions paid.

Overnight Fees

This charge is present on many broker sites. It is a fee charged to traders for holding positions overnight.

On IQ Option this fee is between 0.01% to 0.5%. However, it is three times higher for positions left open from Friday to Saturday. Either way, clients can check the rate they have to pay on the IQ Option site as the broker is transparent on the fees.

Inactivity Fee

This charge is a service fee for maintaining accounts that go without activity for a period of time. On IQ Option, an inactivity fee is charged if, for 90 consecutive calendar days or more, a client does not place orders or make trades. The broker will charge a fee of €10 on a client account balance monthly until the account becomes active again.

Did you know?

IQ Option trading platform has one of the quickest average order execution times at merely 0.6s.

04

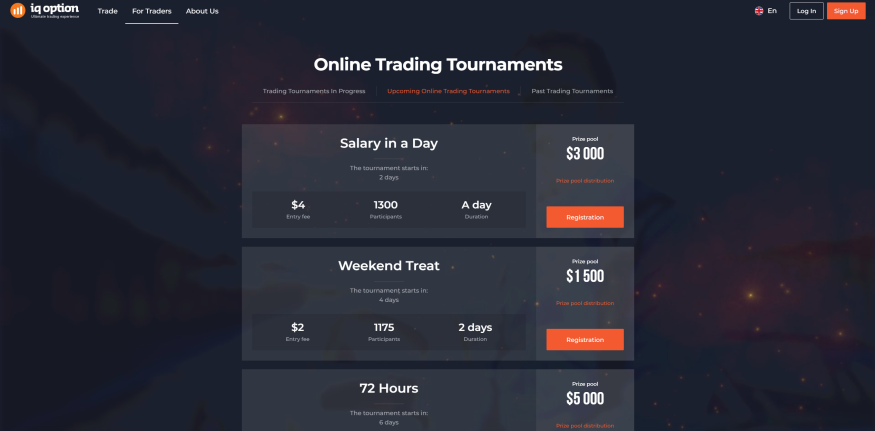

IQ Option Tournaments

Traders from Nigeria can participate in the trading tournaments held by IQ Option. The tournaments require a small entry fee and winners receive a prize. Each participant gets access to a tournament account with the same balance as the rest of the traders.

They can then trade whatever asset and manage their own order sizes. The entry fee can be as low as $2 to $4 and the prize pool is between $1,500 to $5,000.

05

IQ Option Leverage

Depending on what assets you trade you can use a different maximum leverage. Here is the breakdown of the maximum leverage Nigerian traders can use on IQ Option:

Forex 1:500

Stocks 1:20

Commodities 1:50

Indices 1:100

Cryptocurrencies 1:100

ETFS 1:20

Did you know?

IQ Option first started only as a binary options broker but later on, expanded their offering drastically by offering forex and CFD

06

IQ Option Education and Demo Account

An education section on a broker site is one of the best resources for traders. Although mostly overlooked, it helps beginner traders familiarize themselves with the ins and outs of trading. Moreover, it helps experienced traders brush up on some concepts to improve their strategies. Luckily, IQ Option has such a section on its website for traders.

The market analysis section helps traders to get fast and accurate information regarding the market. What's more, IQ Option offers video trading tutorials teaching traders the basics of trading. The lessons can range from general trading information, technical analysis, fundamental analysis, and margin trading.

Better yet, IQ Option provides traders with a free demo account to practice trading strategies. This account is non-expiry and comes with $10,000 in virtual funds. Worry not, the account is replenishable at a request.

This is important for traders to practice their approaches risk-free in a virtual environment before deploying them in the market. Moreover, the account allows new clients to test the services offered by the broker before committing.

Trading Forex and CFDs entail risk.

Trading Options is also risky.

Your capital is at risk.

07

IQ Option Unique Features

Multi-Chart Layout

This is a feature provided by IQ Option that allows traders to track the prices of more than one market instrument at a time. To do this, a trader can simply click on the chart layout icon and select the layout they like. Once there, they can choose the assets whose prices they want to track. They can even click on an asset already on the chart to select a different one.

Auto-closing Feature

This is yet another useful feature of the IQ Option trading platform. It works similarly to a stop loss and take profit. Traders can set a target profit/loss amount, percentage, or even instrument price. The feature will keep track of the price and close the order once the target is reached. Essentially, this is a risk management feature for clients of IQ Option.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds. You should never invest money that you cannot afford to lose

IQ Option in head-to-head with Nigerian leading competitors

Trading Forex and CFDs entail risk.

Trading Options is also risky.

Your capital is at risk.

Expert's critical opinion

from the author of this IQ Option Review

IQ Option’s number of clients has increased by more than 800% from 2014 when the broker first got their license. As of today, the broker has more than 1,338,793 trades per day and over 48,000,000 registered users. With these kinds of numbers, we can see why the broker is highly rated in Nigeria.

We want to understand just how well IQ Option serves its Nigerian clients. To do this, we must compare its services to those of competing brokers in Nigeria. In this case, we are going to put IQ Optionhead to head against XM.com and Exness.

In terms of the number of trading instruments, XM has the edge. It beats out both IQ Option and Exness by a mile. Specifically, XM offers more than 1,000 different trading instruments. In comparison, IQ Option offers just slightly over 250 instruments while Exness comes in with just over 200 assets.

Next, let’s look at the trading fees charged by each of the brokers. Unfortunately, IQ Option does not fare well in this category either. Both XM and Exnes offer lower spreads than IQ Option. On this broker site, the spreads go as low as 1.0 pips for major currency pairs. Contrarily, on Exness they start from 0.3 pips and on XM they start from 0.6 pips.

Finally, let’s look at the entry point for the three brokers. Well, they all compete very well with favourably low entry points. Both Exness and IQ Option accept a minimum deposit of $10 which is affordable to most traders in the market. However, XM has an even lower minimum deposit requirement sitting at only $5.

Peter Cook Ndungo

Editor, Senior Broker Analyst

Trading Forex and CFDs entail risk.

Trading Options is also risky.

Your capital is at risk.