Best Nigerian Brokers With NAS100

NAS100, or NASDAQ 100 or US 100, is a US stock index made up of 102 of the largest non-financial companies listed on the NASDAQ exchange. Notably, NAS100 is one of the three indices published by NASDAQ and the leading stock index in the market. The NAS100 features companies such as Apple, Microsoft, Amazon, Tesla, and many more. It's important to note that only non-financial companies are listed in the NAS100.

Taking into account that NAS100 is a stock index, a trader does not actually own the asset but speculates on its movement and can only go long or short. Several factors including share price, trader sentiment, and political events move the NAS100.

Today we will look at some of the best Nigerian brokers with NAS100. But before that, let’s look at two crucial things.

Is NAS100 Available in Nigeria?

Yes, several brokers offer NAS100 to Nigerian traders. Traders can ask their broker directly regarding NAS100 or get the details on the broker’s website. Reputable brokers are transparent and will list the types of trading instruments they deal with on their platform. The only thing to note is that you should make sure you choose a broker that is regulated by a reputable organization.

How Much Does a Trader Need to Trade NAS100?

The amount of money a trader needs to trade NAS100 depends on the broker that they choose. Some brokers offering NAS100 have fairly low entry points while others are fairly expensive. Some brokers don’t even have a minimum deposit amount. This means that traders can invest whatever they have and start trading NAS100. Now let's get into it.

Nigerian Brokers with NAS100

Exness

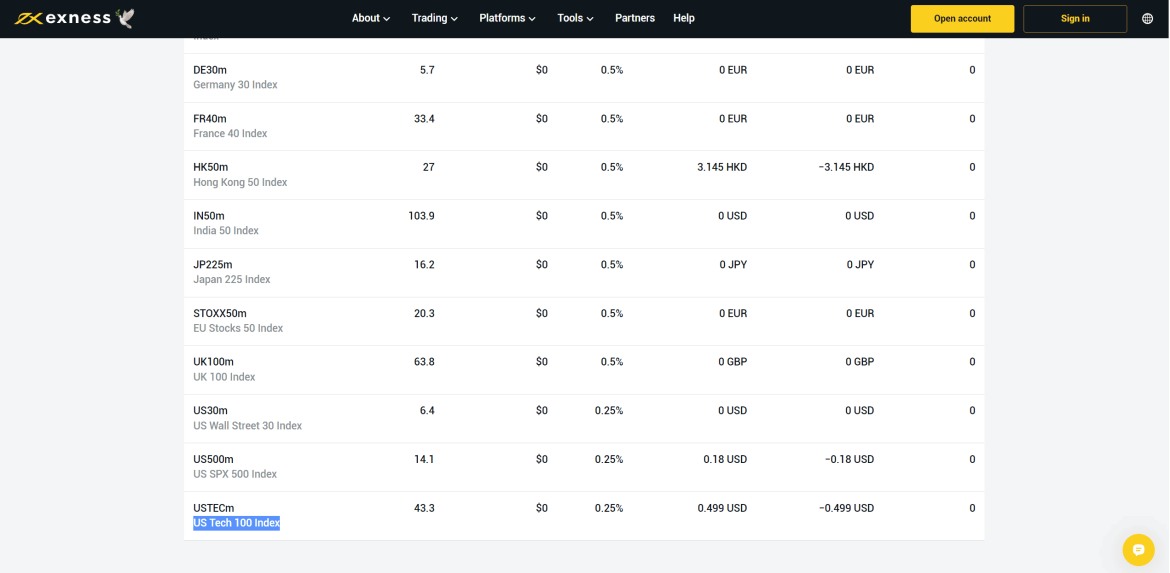

Exness is regulated by two different organizations in Africa including the FSCA and the CMA. On top of that, it has regulations from two top-tier organizations including the FCA and the CySEC. Exness offers traders more than 250 different trading instruments. The markets available to invest in include forex, cryptocurrencies, stocks, energies, and indices (including NAS100). On this broker site, the asset is listed under the symbol USTEC.

The broker offers different average spreads depending on which account you use to trade the index. The standard account offers an average spread of 49.6 pips with no commission when trading NAS100. In contrast, the raw spread offers an average spread of 16 pips with a small commission of $0.625 per lot per side. Finally, the zero account offers an average spread of 3.5 pips on the index and a small commission of $1.25 per lot per side. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and Exness Terminal. The broker supports having a base account currency either in USD or in Naira.

Screenshot taken from the official Exness site (Trading > Indices)

Prices are indicative only. Check your platform for the most up to date prices.

XM.com

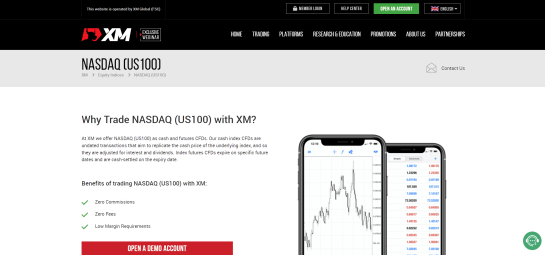

XM.com offers NAS100 to Nigerians and refers to it as US100. At XM.com, they offer NAS100 as Cash and Future CFDs. Both the cash and future CFDs have spreads that start as low as 1.10 pips and 3.00 pips respectively on the micro, standard, and XM Ultra low accounts. XM offers three benefits of trading NAS100 which include zero commission, low fees, and low margin requirements. NAS100 is only tradeable at XM.com from 01.05 and 23.55 (GMT +3) on weekdays.

XM.com offers various other trading instruments to its clients. Nigerians can trade over 1,000 instruments that include CFDs on Forex, commodities, indices, stocks, shares, energies, and more. The trading platforms available for clients to use include MetaTrader 4 and MetaTrader 5.

Further, the broker has regulations from international bodies that enable it to stand out among other brokers. XM has regulations from the CySEC in Cyprus and the FCA in the UK on top of that, it is regulated by the FSC.

Screenshot taken from the official XM.com site (Trading > Instruments > Equity indices > US100Cash)

Prices are indicative only. Check your platform for the most up to date prices.

Pepperstone

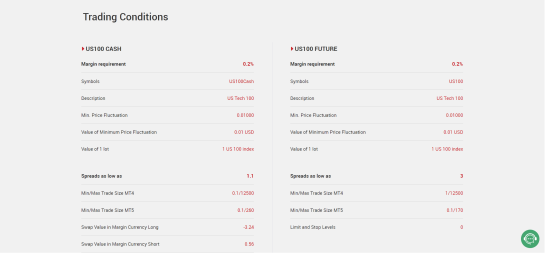

Pepperstone is yet another broker that offers the NAS100 index to Nigerian traders. The index is tradable between 01.00 and 23.59 GMT under the symbol NAS100. Pepperstone also offers a competitively low spread for trading the index. The minimum spread offered by the broker is 1.0 pips and the average is 1.4 pips. The broker is regulated by several reputable organizations in the market. They include the CMA in Kenya, the CySEC in Cyprus, the ASIC in Australia, the FCA in the UK, and Bafin in Germany.

Further, Pepperstone provides other trading instruments for traders to diversify their portfolios. A trader can invest over 1,200 CFDs on forex, commodities, cryptocurrencies, shares, and ETFs. Moreover, traders can use market standard trading platforms offered by the broker to trade the various instruments. These include Meta Trader 4, Meta Trader 5, cTrader, and Trading View.

Screenshot taken from the official Pepperstone site (Markets > Indices > NAS100)

Prices are indicative only. Check your platform for the most up to date prices.

FP Markets

FP Markets was established in 2005 and is one of the most popular brokers in the market. The broker has years of experience and it is no surprise that it's highly rated. With this broker, Nigerian traders gain deep liquidity in addition to offering NAS100. This is because FP Markets is an ECN broker that sources liquidity straight from the interbank market. The NAS100 is available as a CFD under the ticker US100 with fairly low spreads averaging 1.51 pips. The maximum leverage for trading this instrument sits at 1:200.

Other than NAS100, there are a plethora of other assets to trade. In total, there are over 10,000+ trading instruments a trader can choose from including forex and CFDs on shares, commodities, bonds, EFTs, and cryptocurrencies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, Iress, and cTrader. FP Markets has regulations and licenses from various jurisdictions. The broker is subject to supervision by the FSCA in South Africa, the CySEC in Cyprus, and the ASIC in Australia.

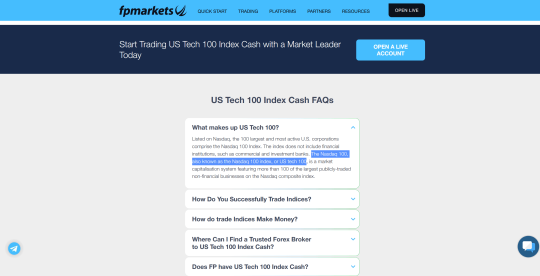

Screenshot taken from the official FP Markets site (Trading > Markets > Indices > US100)

Prices are indicative only. Check your platform for the most up to date prices.

XTB

On the XTB broker site, traders can find the NAS100 index under the symbol US100. The minimum spread offered for NAS100 is 0.9 pips, which is competitively low. What's more, the broker offers a leverage of 1:20 when trading NAS100. The broker doesn't charge a commission when trading the index and the market hours are between 12.00 am and 11.00 pm.

XTB has licenses and regulations from several reputable organizations in the market. They include CySEC in Cyprus, the FCA in the UK, and the KNF in Poland. Further, XTB traders can invest in a wide range of global markets that include forex, commodities, cryptocurrencies, equities, ETFs, and indices. Furthermore, clients can invest using XTB’s market-standard in-house trading platforms which include xStation 5 and xStation mobile.

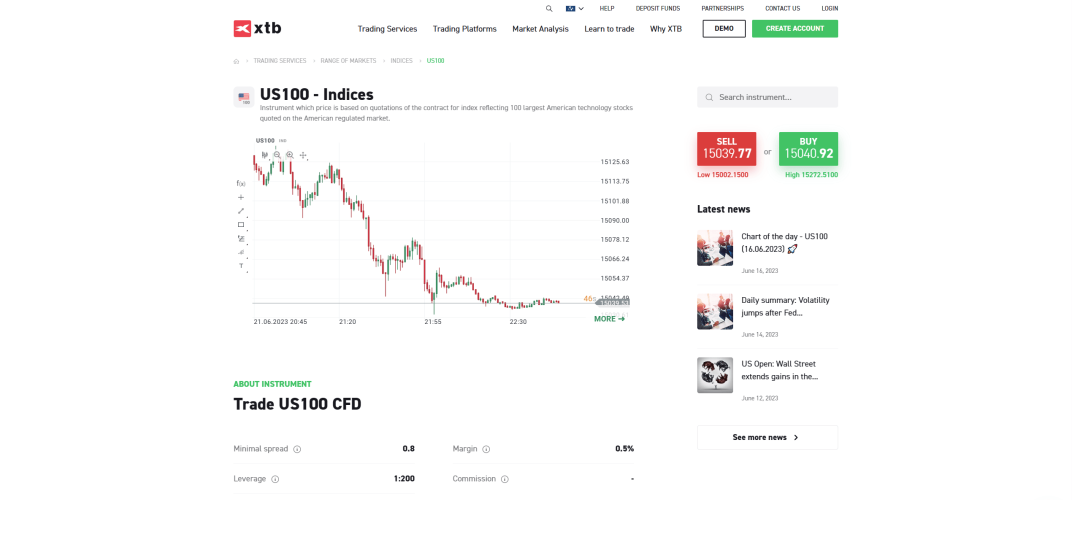

Screenshot taken from the official XTB site (Trading services > Range of Markets > Indices > Check all instruments > Show all > US100)

Prices are indicative only. Check your platform for the most up to date prices.

AvaTrade

Traders can find the NAS100 index on AvaTrade as US Tech 100. When trading NAS100 a trader can access a maximum leverage of 1:200. This is lower than the maximum leverage available for forex which is 1:400. Notably, NAS100 is available for trading on AvaTrade only between 22.00 and 20.59 (GMT). AvaTrade offers a minimum spread of 1.0 pips on NAS100 and a margin of 0.50%. The lowest spread AvaTrade offers is 0.9 pips for major currency pairs. Swap fees apply when trading this instrument on AvaTrade with the sell swap sitting at -0.0006% and the buy swap at -0.0216%.

In terms of regulations, AvaTrade operates under the supervision of various institutions across the world. These include the FSCA in South Africa, CySEC in Cyprus, and the KNF in Poland, among others. Further, AvaTrade has over 1,250 tradable assets for Nigerian traders. The global markets available include forex, metals, commodities, bonds, equities, and ETFs. These markets are tradeable on platforms that include MetaTrader 4, MetaTrader 5, AvaTradeGO, and WebTrader.

How to choose a NAS100 broker in Nigeria

There are five key features to look at when choosing Nigerian brokers with NAS100. To make our selections, we specifically looked at the following five sectors.

- Regulations and Licenses - The regulatory status of a broker is probably the most important thing to look at before investing your money with any company. You should only pick companies that have reputable regulations in the jurisdictions they operate. As Nigeria does not have an existing regulatory environment, Nigerian traders should pick brokers with world-class regulations in other countries. Some of the best regulators to look out for include the FSCA, the CMA, the FCA, the CySEC, and the ASIC.

- Availability of NAS100 - It goes without mentioning that the broker you choose has to offer NAS100 to Nigerian traders. The broker you choose must not only list the index on its collection of instruments but also accept traders from Nigeria.

- Trading Fees - Considering a trader does not want to pay large sums of money we are going to look at brokers with competitively low fees. As brokers offer different trading fees, traders should pick the brokers that offer competitively low fees to maximize their earnings.

- The Trading Platform - The trading platform offered must be suitable for all kinds of traders and offer fast execution speeds. It must offer advanced trading tools plus an intuitive interface. This helps traders maximize its functionality.

- Customer Reviews - It is important to check what people are saying about a particular broker before investing. This will give you some perspective on what you should expect from the broker when you do actually invest.

Benefits of Trading NAS100

What are the benefits of trading NAS100?

Several brokers offer NAS100 to Nigerian traders. Nas100 offers several benefits like its diversity which is always welcomed. However, it's important to note that all trading carries risk and traders should first understand the market before investing. While many brokers offer this instrument, it is not the only thing to look at when looking to buy or sell the NAS100 index. Some of the other factors that traders should look at include regulations, trading fees, the trading platform available to use, and the online customer reviews of a company.