Comprehensive Review dedicated to traders from Nigeria

XTB Review Nigeria

Accepts Nigerian Clients

Who is XTB?

With almost 20 years of experience, XTB is one of the market's largest Forex and CFD broker. The company is regulated by several reputable financial regulators. Notably, XTB offers various global markets to its clients and traders can trade with over 2,200+ instruments and 48 forex pairs, which include forex, indices, commodities, stock, and crypto. The trading solutions and strategies offered by XTB help traders achieve their trading ambitions.

Interestingly, this broker does not have a minimum deposit requirement. This means that the XTB minimum deposit is $0 which also, of course, equals to 0 NGN (Nigerian Naira).

XTB Group is Regulated by

FSC

Financial Services Commission, based in Belize, license no 000302/438.

FSCA

Financial Sector Conduct Authority, based in South Africa, license no 49970.

FCA

Financial Conduct Authority, based in the United Kingdom, license no 522157.

CySEC

Cyprus Securities and Exchange Commission, based in Cyprus, license no 169/12.

Risk warning: Remember that forex and CFDs available at XTB are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Pros

Cons

01

Trading assets

XTB traders have access to a wide range of trading instruments. With the diversity offered by XTB, Nigerian traders can spread their investments across various global markets. In total, there are over 2200+ trading instruments (CFDs) available and they include:

- Forex – XTB offers 48 different currency pairs that include EURUSD, AUDUSD, AUDJPY, and many more. Traders can trade majors, minors, and a plethora of exotics.

- Stocks – Company stocks from countries like the UK, the US, and many more, are also available to buy and sell on XTB. Some of the stocks offered include AAPL.US, AMZN.US, and BARC.UK and BMW.DE.

- Indices – The broker offers over 20 indices from all over the world including countries like the USA, Germany, and China. The indices available for Nigerian traders include UK100, DE30, US500, US2000, FRA40, EU50, and many more.

- Commodities – XTB also allows its traders to diversify their money by investing in commodities. A trader can trade popular commodities like gold, silver oil, Natural Gas, COCOA, and more.

- Cryptocurrencies – XTB offers a variety of cryptocurrencies for traders to invest in. There are over 10+ crypto CFDs for Nigerian traders including Bitcoin, Ethereum, Steller, Dogecoin, and more.

- ETFs (CFDs) – A trader can also trade over 60 ETFS with no commission on the XTB trading site.

Available Deposit & Withdrawal Methods

XTB supports the following deposits and withdrawal methods

Supported Platforms by XTB

XTB supports the following trading platforms

02

Trading platform of the broker

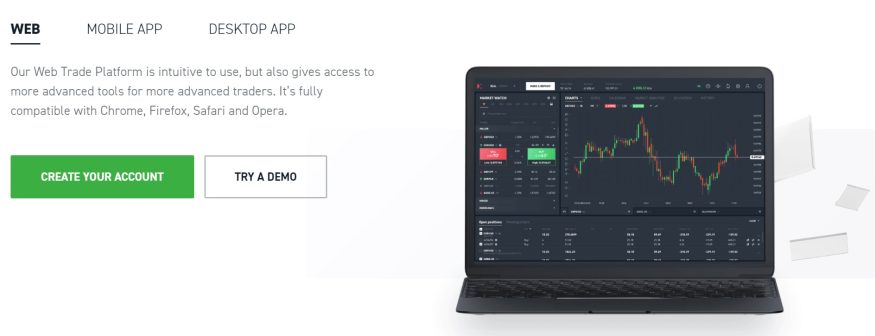

XTB provides Nigerian clients with its in-house-built trading platform, xStation 5 and xStation mobile. The software is industry-standard and meets the needs of the majority of traders online. The platform’s simplicity is suitable for both advanced and new traders. On top of that, XTB promises superior execution speeds to its Nigerian clients.

What's more, the platform is equipped with professional analytical tools that can help traders in their technical analysis. Further, the platform gives access to more advanced tools for advanced traders and is also fully compatible with Chrome, firefox, safari, and Opera, among other browsers.

xStation mobile platform is designed for mobile users where a trader can trade at any given time. They can also stay up to date with news related to the market to make fast decisions when needed.

When using the app, a trader can manage risk before placing an order by setting up a stop loss and taking profit levels quickly and comfortably by controlling them directly from the chart or through the advanced trading calculator.

Screenshot taken from the official website of XTB, page trading platforms

Did you know?

XTB is one of the largest stock exchange-listed FX & CFD brokers in the world with offices in over 13 countries.

03

Review of XTB Trading Fees

There is mainly only one trading account on XTB, the standard account. The company believes that this account is customised to suit all kinds of traders, both beginner and experienced. The spreads on this account are competitively low, making XTB one of the lowest spreads forex brokers in the world.

Traders can enjoy spreads that start from as little as 0.5 pips on major currency pairs. There are no commissions charged by XTB when trading on the standard account. The other fee that applies is the swap fee charged for holding positions overnight. This fee varies depending on the asset a trader is holding and the size of the position held.

However, a swap-free account is available for traders who cannot pay overnight fees. This account is best suited for Muslim traders who cannot pay swap fees due to religious beliefs.

This swap-free account features similarly low spreads that start from as low as 0.7 pips for major currency pairs. Additionally, there are no commissions charged on this account just like the standard account.

04

XTB’s Research and Education XTB

On XTB’s Learn How to Trade section, there is a full knowledge base filled with all kinds of resources. Traders can make use of its extensive course library to learn more about trading. The trading academy contains courses that vary from basic, intermediate, and expert levels.

These courses will help beginner traders to familiarize themselves with XTB and with trading in general. Advanced traders can also use them to sharpen their knowledge and trading strategies.

Apart from the courses offered, there are other tools XTB is equipt with to help traders gain knowledge. They include trending topics, technical analysis, and fundamental analysis.

What's more, traders on XTB can stay up-to-date with global news that will help them make fast and sound decisions. There are three tools available on XTB to help a trader to react fast using market information and they include market news, price tables, and market calendar.

05

XTB Customer Support

Customer support service is one of the crucial aspects of any company. When dealing with clients' funds, it's important for a client to be able to receive support in case they have an issue and XTB has various channels to support that.

The live chat support feature is available to clients 24 hours a day, 5 days a week. They can use this feature to resolve simple issues that can be worked out through simple prompts.

Additionally, traders can contact the company via its mobile phone and its email. Lastly, there is a help centre on the broker website where traders can find answers to a few questions that bother most traders.

Did you know?

XTB has some of the best world-known ambasards including Conor McGregor, Iker Casillas and Jiri Prochazka

06

Demo Account, Cashback Rebates and API Trading

XTB offers free demo accounts for all its traders. The demo account has various perks like giving traders access to over 3,000 real stocks and ETFs with 0% commission for traders with a monthly turnover of up to €100,000.

Traders that fall below that threshold trade with a small commission of 0.2% in virtual funds. A demo account is one of the best ways to test out strategies before using them in the real market. The account is accessible for both xStation 5 and xStation mobile users.

Further, on XTB you can earn a cashback rebate created for high-volume traders. Different eligibility rules apply depending on where you trade from. The calculations are done at the end of the month and deposited within 7 days after the prior month's end. The amount of cashback a trader makes depends on the trading volume they have that year.

Nigerians can get API trading on XTB and link their trading portfolio to external platforms they wish to use when trading. API trading uses a computer program to allow for automated trading through external platforms like EAs and trading bots.

Traders can benefit through increased speed on trades, accuracy, and better risk management. However, there are still some drawbacks to API trading and customers should be very careful. People with technical know-how can code their own programs to use with the XTB API. XTB’s API can send, cancel orders, and retrieve live prices and historical data.

XTB in head-to-head with Nigerian leading competitors

Expert's cricital opinion

With over 15 years of experience and over 615,000+ customers the broker has acquired over the years its no surprise why the broker is highly rated in Nigeria. Moreover, it offers Nigerian traders some of the best trading conditions. These include low spreads and fairly high leverage. However, to better grasp just how well this broker serves Nigerian traders, we must compare it to some other top-rated brokers in the country. For this review, we are going to compare XTB with XM and Exness.

First, XTB has the edge when it comes to the number of assets the broker has to offer. XTB offers more than 2,200 assets for traders to invest in. In comparison, Exness features only slightly over 160 instruments while XM has just above 1,000 trading instruments. It's fair to say that XTB offers more portfolio diversification opportunities.

In terms of spreads, all three brokers are within industry standards. Exness offers the lowest spreads on its standard account starting from 0.3 pips for major currency pairs. XTB follows with spreads that start from 0.5 pips, while XM offers spreads from 1.0 pips on its standard account. However, XM also offers an ultra-low account with spreads from 0.6 pips with no commissions. Exness also offers lower spreads starting from 0.0 pips with a commission paid.

In terms of the minimum deposit accepted, all three brokers feature quite a low entry point. XTB has no minimum deposit requirement which makes it stand out. Contrarily, XM expects a minimum deposit of $5, while Exness accepts a $10 minimum deposit from traders.

Finally, let’s look at the trading platforms offered by each of the brokers. Unfortunately, XTB does not fair well in this category. It only offers its in-house-built platform, xStation 5. Exness and XM offer their traders both the MetaTrader 4 and MetaTrader 5. These are widely considered the best trading platforms in the world. Moreover, it is nice to have variety and to allow traders to select the platform that better suits their trading needs.

Peter Cook Ndungo

Editor, Senior Broker Analyst