Best Synthetic Indices Brokers

Synthetic indices are a class of special trading instruments that mimic the behaviour of actual financial markets. Synthetic indices allow investors to speculate on an asset without worrying about real-world events. Therefore, they are devoid of liquidity and market hazards because they are based on random number generators.

There aren't many trustworthy brokers that offer access to synthetic indices. In this review, we are going to be looking at some of the best synthetic indices brokers for Nigerian and international traders. We will focus on the availability of said synthetic indices, the trading conditions, and the regulatory status of the brokers. But first, let's learn about the different types of synthetic indices.

Types of Synthetic Indices

There are six major categories of synthetic indices available for trading on different broker sites. These include volatility indices, step indices, range break indices, crash and boom indices, jump indices, and daily reset indices. The most popular category of synthetic indices, volatility indices imitate genuine markets with fixed volatility of 100%, 75%, 50%, 25%, and 10%.

There are only four possibilities accessible in the crash and boom category of synthetic indices. These are the Boom 500 index, Crash 1000 index, Boom 1000 index, and Crash 500 index. On the other hand, range break indices range between two price boundaries. But occasionally, they cross those limits to form a new range. This typically occurs once every 100 or 200 times when the price contacts the range borders. Daily reset indices, which are reset every day at 12:00 GMT, duplicate markets with ongoing volatility to display bullish and bearish tendencies. Lastly, jump indices are created to correspond to simulated markets with a fixed volatility of 100%, 75%, 50%, 25%, and 10%.

Now, with that out of the way, let’s look at some brokers that offer synthetic indices to Nigerian and international traders. First up is XM.com.

Best Synthetic Indices Brokers

Here is a list of some of the Best Forex and CFDs brokers that support trading on Synthetic indices

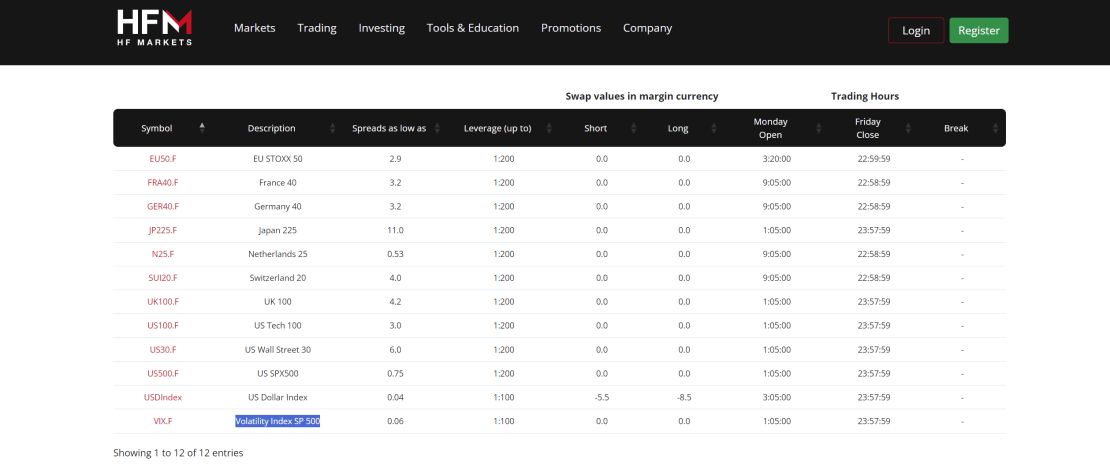

HFM offers a competitive trading environment for the VIX synthetic index futures CFD. Traders can benefit from exceptionally low spreads starting at just 0.06. Trading is available from Monday at 1:05:00 GMT+2 to Friday at 23:57:59 GMT+2, with no daily breaks. For those seeking to trade VIX with leverage, HFM offers up to 1:100 leverage. This enables traders to increase their potential returns on their initial investment. However, it's important to note that leverage also amplifies potential losses. HFM offers the popular MetaTrader 4 and MetaTrader 5 platforms for trading. Additionally, the broker's proprietary HFM Platform is available to use.

Traders can begin trading VIX on this broker's platform with no minimum deposit requirement, allowing them to start with any amount they choose. In terms of regulation, the broker is supervised by the FSCA in South Africa, the CMA in Kenya, the FCA in the UK, the CySEC in Cyprus, and the DFSA in the DIFC.

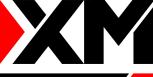

XM allows its traders to greatly diversify their portfolios. This is because it offers them access to over 1,000 different trading instruments. These include CFDs on forex, indices, stocks, cryptocurrencies, precious metals, and energies. One of the indices that the broker offers is the VIX. The VIX index is available with no commissions paid by the trader. Interestingly, the spreads are competitively low starting at 0.05 in quote currency. The maximum leverage available for trading this asset sits at 1:100. While both the MT4 and MT5 are available, traders can only use the MT5 to trade VIX.

Additionally, XM offers more than 1,000 other instruments to its traders. These include assets in the Forex, Cryptocurrencies, Stocks, Commodities, Precious Metals, Energies and Equity Indices markets. The broker also newly added an asset category called thematic indices. Here you can find a number of synthetic indices such as Artificial Intelligence Giants US Index, China Internet Giants Index, Crypto 10 Index, Electric Vehicles UST Index, NFT and Blockchain Giants Index. The maximum leverage for the thematic indices is 1:50.

Notably, XM has supervision from top-tier regulators in the world. These include the Cyprus Securities and Exchange Commission (CySEC) and the DFSA in Dubai, among others.

Pepperstone

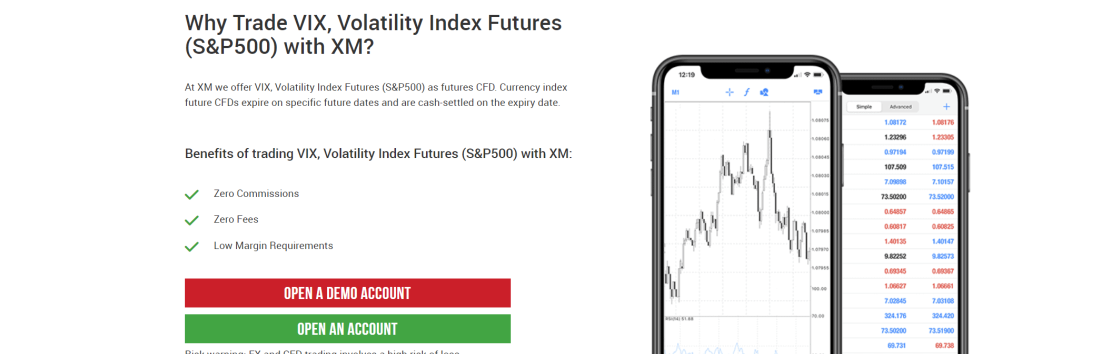

Pepperstone is one of the brokers that offers synthetic indices to traders. The CBOE volatility index, sometimes known as the VIX Index, is one of the most well-known indicators of implied volatility. It is one of the synthetic indices available on Pepperstone. The VIX index is simply a gauge of anticipated S&P 500 movement. Like any implied volatility measure for options, it is expressed as an annualized standard deviation percentage. The spreads for trading this index on Pepperstone are as low as $ 0.16 and traders get access to a max leverage of 1:10. Meanwhile, the platforms available for clients to place trades on include TradingView, MetaTrader 4, MetaTrader 5 and cTrader.

In addition to synthetic indices, Pepperstone also offers other trading instruments across the Forex, indices, equities, energy and commodities markets. Pepperstone offers two trading accounts which include the Standard and Razor accounts.

Closing out, Pepperstone is regulated by several organizations including the CMA in Kenya, the CySEC, the FCA, and the ASIC. Notably, there is no minimum deposit for those looking to start trading.

FP Markets

FP Markets offers access to global markets that include forex, indices, stocks, cryptocurrencies, shares, and ETFs. Among the indices that this broker offers is the VIX index. The trading conditions for trading this asset are fair on market-standard trading platforms. Firstly, the spreads for this asset on this broker site are low starting at $0.16. Secondly, the maximum leverage is fair sitting at 1:20 for indices. Further, the trading platforms available for traders are some of the best in the market. They include MT4, MT5, cTrader, and IRESS. The minimum deposit accepted by this broker is $100.

Top-tier regulations are very important in a forex broker. Accordingly, FP Markets has regulatory licenses from reputable regulators in the market which include the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). On top of that, it has supervision and licensing from the Financial Sector Conduct Authority (FSCA). With this broker, Nigerian traders have a well-supervised company to trade with.

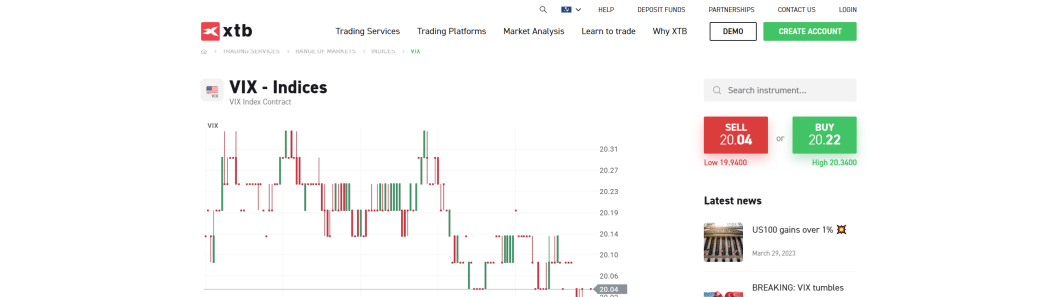

XTB

XTB is another broker site that allows traders to trade synthetic indices. Investors can trade the VIX index with some of the best trading conditions. First, traders place orders on the company’s xStation 5 trading platform with spreads as low as $0.2. Additionally, there are no commissions charged for trading this instrument and the margin requirements are low. The maximum leverage traders can access for this asset sits at 1:5.

The trading hours for the volatility index run from Monday through Thursday, 00:00 CET to 22:15 CET, and Friday, 00:00 CET to 22:00 CET. On the XTB platform, trading VOLX is not available on the weekends. When the market is closed, the VOLX price is constant. The costs are always changing at different times.

Nonetheless, it is easy to diversify one’s portfolio on XTB. This is because it provides clients with over 1,500 financial products. These include other indices, currency pairs, equities, metals, cryptocurrencies, and commodities. Evidently, this is a great collection of market instruments.

XTB is subject to regulation by a number of authorities throughout the world. These include world-class regulators like the FCA in the UK, the CySEC in the EU, and the KNF in Poland. Additionally, it has regulations from the Financial Sector Conduct Authority (FSCA) in South Africa.

AvaTrade

Trading Forex and CFDs entail risk. Your capital is at risk.

AvaTrade is another well-known broker that provides synthetic indices, particularly the VIX. Traders have access to this product as a leveraged asset up to a leverage of 1:20. The typical spread for trading this instrument sits at 0.15%. Additionally, AvaTrade offers investors a unique alternative to trade the VIX outside of the futures and options markets. The Inverse VIX ETN (VXXB), which is available as an index, offers traders the profitable opportunity to maximize potential revenue in a risk-controlled setting. S&P 500 VIX Short-Term Futures ETN is offered at the same typical spread of 0.15%.

AvaTrade offers several platforms, including MT4, MT5, WebTrader, and the AvaTradeGO app. Aside from synthetic indices, AvaTrade also offers assets in Forex, Stocks, Commodities, ETFs, Options, and Indices markets. It has licenses from the ASIC, the FSCA, and the CySEC, among other regulatory commissions.

IC Markets

IC Markets offers synthetic indices in the form of futures. Futures from many countries are available via IC Markets, including the ICE Dollar Index and CBOE VIX Index. Traders have access to this asset on market standard platforms including MT4 and MT5. There is no commission paid on Futures CFDs when trading on the IC Markets platform.

As we observed, IC Markets has three trading accounts. These include the Standard account and two Raw Spread accounts on two different trading platforms. One of the Raw Spread accounts is on the MetaTrader platforms, while the other is on the cTrader platform. Traders have access to a plethora of other global markets including forex, indices, shares, commodities, cryptocurrency, futures, and stock.

Now let’s look at the regulatory status of this broker. Well, it has regulatory licenses from the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC). These are two of the best financial regulators in the market today.

When it comes to the market and general sentiment, the VIX index is undoubtedly an important indicator. This is why most reputable brokers offer the VIX index for trading. This asset is available on most trading sites as a leveraged product. Although it can be dangerous, leverage can increase a trader's profits. Active traders who enjoy risk and price volatility enjoy trading the VIX index. The VIX, like other market tools, has its advantages and disadvantages, and there are others who think it may not be the best indicator of market sentiment. Despite this, when attempting to gauge volatility, this index is still one of the most frequently used.

In this review, we looked at some brokers that offer Synthetic indices to Nigerian traders. Specifically, we looked at brokers that offer the VIX index. Since this is not a complete list, we encourage each individual trader to do their own research. That way, they can select a broker that best suits their needs.